iCDS app for iPhone and iPad

Developer: iJaz Software

First release : 05 Feb 2010

App size: 354.07 Kb

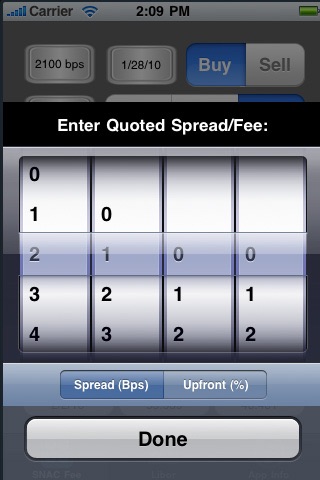

The 1.0 version of the application will implement a SNAC(Standard North American CDS), upfront fee calculator using the ISDA Standard CDS Model, www.cdsmodel.com and based on the functionality found on the MarkIt partners website, www.markit.com/cds. The application is free. Its only objective is for the author to have a non-trivial application in the iPhone AppStore. The approach of the application is to recalculate the upfront fee and intermediate results and display them as the user changes outputs using the quick entry controls or the pickers accessed by pressing the buttons displaying the inputs.

The application does all calculations locally on the device. It is reliant on WIFI connectivity to download the LIBOR curve published by ISDA via MarkIt partners from www.markit.com when the application launches or when the trade date or currency is changed.

Here what is happening in concept..

It calculates the upfront fee on a Credit Default swap, which is basically the same concept as a points upfront on a mortgage or unsettled interest on a bond. Say you buy a bond today that started accruing interest 12/21/2009 and it pays its interested coupon on 3/20/2010.

The person that holds the bond on 3/20/2010 gets the full interest covering the entire period from 12/21-3/20. Considering this when you buy the bonds, say today on 2/5/2010 then the person buying the bond is entitled to the interest accrued from 12/21 to 2/5 which is 47 days of interest. In the bond market when you buy a bond, say at 98, this is a clean price and you pay the person .98*Face + unsettled interest on the current coupon.

In a nut shell this is the basis of the calculation in the application. As we are doing a Credit Default Swap not a bond there are a few more components to the economic of the # but this is the basic concept. The fee is actually the accrued interest on the current coupon plus the difference in present value of the contract at the fixed spread and the same contract at the quoted spread.

Credits

* ISDA Standard Model ( www.cdsmodel.com ) - the heart of the functionality

* Contributors to code.google.com for the ZipArchive source

* Gilles Vollant for his minizip zlib wrapper

* www.iPhoneSDKArticles.com for the XML parsing source from the iPhone SDK Articles on 11/23/08

* Stanford University/ITunes U for the iPhone Application Programming Course

* Alan Who for the free keyboard icons used for the silver buttons at http://keyboardicons.com

Author: James A Zucker

Background

I started this project when as a former Mac developer I was swept up by the excitement of the iPhone App phenomenon. This led me to a drive to get a non-trivial application into the App Store. I convinced my family to buy me a MacBookPro for my birthday in Sept, 2009 and about 20 hours of effort latter I had my first GUI prototype running on the simulator.

Along the way I have learned a lot about the rich environment of information sharing now happening in the development community. I was reintroduced to the Apple Development Tools (XCode) and the Snow Leopard OS. Not having touched MPW(Macintosh Programmers Workshop) in over 15 years, it was like I never left home with the added power of the underlying LINUX environment that I am well versed in using every day at work. I then was introduced to new resources including ITunes U, blogs and code.google.com.